BizBuySell

January 9, 2017

BizBuySell.com’s Fourth Quarter 2016 Insight Report shows small business transactions continue to reach new highs as growing financials make for a hot market

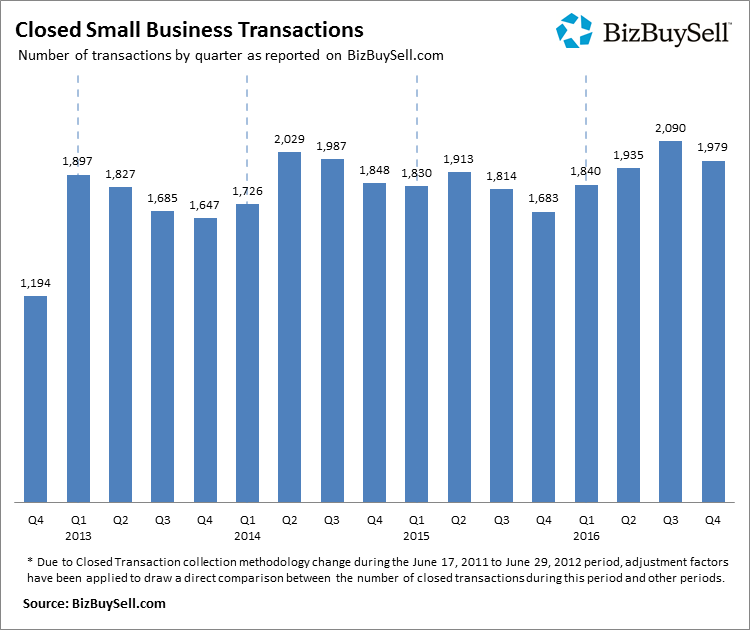

San Francisco, CA – BizBuySell.com, the Internet’s largest business-for-sale marketplace, reported today that annual small business transactions reached record levels in 2016, topping 2015’s totals by 8.6 percent and 2014’s previous high by 4.6 percent. The full results are included in BizBuySell’s annual and Q4 2016 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

A total of 7,842 closed transactions were reported in 2016, the highest yearly total of small business sales since BizBuySell first started tracking data in 2007. This total confirms the positive assessment of the 2016 small business market by business brokers as recorded in BizBuySell’s December survey. According to the survey, 63 percent of respondents experienced more deals in 2016 than in 2015. Primary factors for the reported growth include an improving small business environment, more owners looking to sell, more qualified buyers on the market and better financing options.

2016 financial indicators echo the sentiment of an improving small business environment. The median revenue of sold businesses grew 5.2 percent from $449,462 in 2015 to $472,798 in 2016. Median cash flow also increased, up to $107,551 from $102,000 the year prior. These growing financials likely enticed more buyers into the market, spurring transactions.

Despite the increased demand in 2016, owners did not respond with higher prices. The median asking price remained flat from 2015 at $225,000, while the median sale price increased a mere half a percentage point to $200,000. These figures put the average sale-to-asking price ratio at 92 percent. Such a strong ratio indicates the market is becoming more balanced, with both parties coming closer together in their assessment of fair market value.

“After several years of strong business-for-sale activity, it is great to see even more growth in 2016,” Bob House, President of BizBuySell.com and BizQuest.com said. “Not only are more small businesses changing hands, but healthier businesses put the new owners in a great position for continued success. This bodes well for the market, but also points to a bright future for small businesses overall.”

Fourth Quarter Fuels Annual Transaction Spike; Median Days on Market Falls

BizBuySell’s fourth quarter data reveals that a healthy 17.6 percent year-over-year increase in transactions over the final three months of 2016 helped achieve the year’s record totals. A likely contributor was the median revenue of sold businesses, which increased 8.6 percent year-over-year to $500,250 and was the highest since BizBuySell first started tracking the data in 2007. The median cash flow also increased, from $105,000 in Q4 2015 to $110,000 in Q4 2016. Improving financials gave sellers the confidence to raise their asking prices 4.8 percent to $239,950, while the median sale price improved 3 percent to $206,000. This increase signals that buyers might be willing to pay more for healthier businesses, a theme that will be interesting to watch for in 2017.

As transactions picked up in the last quarter, the time it took for a business to sell dropped to 160 days, an 11.6 percent drop from Q4 2015. That’s also a sharp decrease from earlier this year when the median days on market stood at 188 days in Q1. This drop is most likely a consequence of both buyers and sellers wanting to close on a deal before the year-end.

Finally, as we move into the new year, it’s also worth noting the 7.8 percent year-over-year uptick in Q4 listings, which shows there’s still a strong supply of healthy businesses available for interested buyers. A steady supply will likely persist as more Baby Boomers look to exit small business ownership for retirement and capitalize on the strong market. In fact, according to the aforementioned December survey, seventy percent of business brokers attributed at least a quarter of their closed sales to Baby Boomers, and a resounding 98 percent expect the same amount or more to exit their business in 2017. With buyers attracted to stronger financials and an increasing number of millennials looking to enter small business ownership, signs point to a well-balanced market.

Trump Spurs Optimism for Continued Growth in 2017, However Regulatory Uncertainties Linger

Coming off such a record year, indicators suggest that small business momentum will continue into the new year. In fact, according to BizBuySell’s December business broker survey, 79 percent of respondents expect the number of business-for-sale transactions to improve again in 2017. Forty-five percent anticipate sales prices to increase as well.

2017 broker optimism appears to have a political connection. In the same survey, 31 percent of brokers said they believe President-elect Donald Trump’s policy changes will be the main reason for improvement in 2017. In addition, nearly 60 percent of business brokers believe President-elect Trump’s policies will encourage more buyers to enter the small business market.

Of course, while buyers and sellers expressed a similarly optimistic view of the Donald Trump presidency in the annual Buyer-Seller Confidence Survey released in September, many regulatory and political uncertainties linger. Buyers and sellers entering the market this year should keep an eye on current and upcoming issues such as the final ruling on overtime pay changes, changing health care regulations and global market conditions, and determine if these changes could affect their exit or acquisition strategies.

“Overall, small business indicators point to a healthy market for buying and selling in 2017,” House said. “Although there will certainly be issues to watch under the new Trump administration, as long as small business financials continue to improve and a steady supply of listings enter the market, transaction activity should continue its momentum well into the new year.”

[Article from http://www.bizbuysell.com/news/article122.html]